Germany’s elite soccer body has discontinued discussions with a number of private equity firms about the possibility of selling a minority stake in a company that manages the Bundesliga’s overseas media rights.

In the Media

Private equity investors in the multibillion-dollar soccer market face fresh uncertainty after Europe’s most profitable clubs moved to form a breakaway league.

In New Zealand, rugby isn’t just a sport. It’s a national obsession, a major cultural force and a huge source of pride.

So news that Silver Lake, a private equity firm based in California, is looking to buy 12.5% of the revenue generated by the All Blacks,

Fundraising appears to have bounced back to record levels in the first quarter. Plus: whether football’s proposed European Super League could impact PE’s appetite for the sport, and growth equity is living up to its name. Here’s today’s brief, for our valued subscribers only.

As more private equity companies are investing in governing bodies and federations in sport, Frank Dunne looks whether such investments can raise concerns about the balance of power between investors and recipients.

CVC’s £365m investment to acquire a 14.3 per-cent stake in the Six Nations rugby championship will encourage the six unions to think more collectively and instil a more professional approach in rugby union according to sources familiar with the deal. Ben Cronin reports.

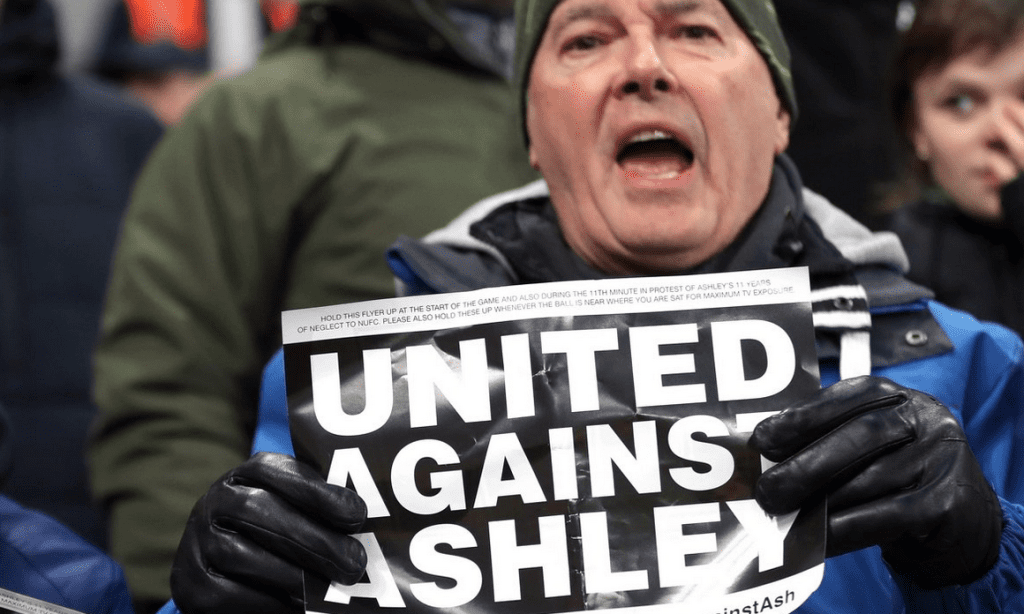

“THE COVID situation has been a disaster for everybody,” says Andy Holt, the owner of Accrington Stanley, a football club in England’s third tier. Fans have been locked out of the stadium since March. The loss of match-day revenue has hit smaller clubs the hardest.

A leading investment expert has said that multiple private equity firms will be interested in buying a minority stake in the English Football League and predicted that the organisation will launch a Serie-A style tender process to identify the best offer.

London-based fund manager Lindsell Train has shown its confidence that the sports and entertainment sectors can bounce back from the Covid-19 pandemic, buying $90m of stock in the sectors in the second quarter of this year.